At lReads-Hub, we bring together a carefully curated selection of books that help readers understand markets, financial systems, behavioural patterns, and long-term economic thinking — without any promotional pressure or commercial messaging.

Explore CatalogueOur mission is to provide readers with reliable, unbiased, and expertly reviewed knowledge. Each book in our collection is examined for its educational contribution, clarity, and real-world relevance. Whether you are strengthening financial literacy or exploring new analytical perspectives, lReads-Hub is here to guide your learning journey.

Choosing the right financial literature can be challenging, especially when the market is filled with promotional content and conflicting guidance. lReads-Hub offers a transparent and independent approach to selecting books related to investing and economics. Our goal is to give readers access to reliable information that helps build knowledge, not quick promises or trends.

Every book is evaluated without commercial influence.

We consider author expertise, research quality, and real-world relevance.

Neutral descriptions help you understand key themes before reading.

Easy navigation across multiple financial topics.

Our recommendations are never driven by advertising or affiliate motives.

Content is chosen for its ability to enhance long-term financial understanding.

We believe that informed readers make better decisions. That is why we prioritise clarity, accuracy, and accessibility in everything we publish. lReads-Hub aims to become a long-term companion for anyone who wants to deepen their understanding of investments, risk, and the world of finance at their own pace.

Financial literature covers a wide range of themes — from behavioural insights to market history and modern risk frameworks. In this section, we highlight titles that readers frequently explore due to their clarity, depth, and practical value. These books offer accessible, research-driven perspectives that help build stronger financial reasoning. The selection changes over time based on popularity and reader interest, keeping the list relevant and useful.

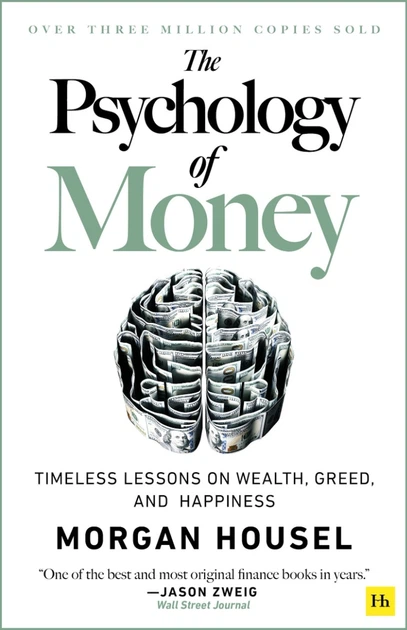

A collection of insightful stories that explain how emotions, behaviour, and personal experiences shape financial decisions more than numbers or theories.

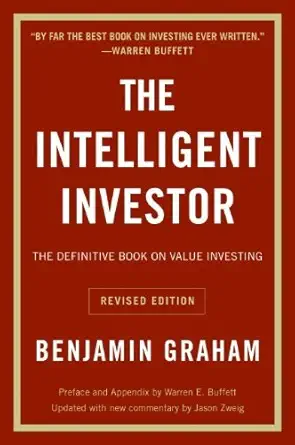

A foundational guide to value investing that explains how to assess companies, manage risk, and make rational long-term financial decisions.

Numbers often tell a story better than words. Here are some key figures that represent our experience, approach, and the foundation of our platform.

Years of Research Experience

Our team consists of analysts, educators, and reviewers with a decade-long background in financial literature and economic analysis.Reviewed Titles

We have assessed hundreds of books across investing, economics, behavioural science, and market theory — selecting only those that offer meaningful value.Sponsored Recommendations

Our independence is central to our identity. Every book is chosen solely for its educational impact, not for promotional cooperation.These numbers reflect our commitment to maintaining a trusted, reader-focused space.

Each month, we highlight one book that has made a notable contribution to investment thinking or financial education. This does not mean it is the "best" book, but rather a meaningful reading experience that adds depth to the understanding of markets, risk, or personal finance. Our Book of the Month helps focus attention on literature that is especially relevant in today's financial environment.

This section offers context about why the selected book stands out — whether due to its research value, practical frameworks, historical insights, or fresh analytical approach. It may explore a current theme, such as sustainable investing, long-term risk, technological shifts, or behavioural patterns in finance. Readers can use this highlight as a starting point to explore new topics or revisit familiar concepts from a different angle.

The featured book demonstrates how disciplined thinking and evidence-based strategies contribute to better financial outcomes. It combines accessibility with depth, making complex ideas understandable without oversimplification.

Read MoreInvesting is more than numbers and charts — it is a combination of knowledge, behaviour, discipline, and long-term perspective. Many misunderstandings about investments come from emotional decisions or limited exposure to high-quality information. This block aims to provide foundational ideas that help readers see the bigger picture behind market behaviour and financial strategy.

Markets fluctuate, but informed investors focus on structural trends and lasting value.

Emotional reactions often influence decisions more than data — understanding this helps reduce mistakes.

Every investment includes uncertainty; the goal is to manage it, not eliminate it.

Books remain one of the most accessible tools for gaining these insights. By exploring various authors and methodologies, readers gain a broader understanding of how finance works. lReads-Hub helps navigate this learning path clearly and independently.

Financial education continues to evolve as new generations explore investing, personal finance, and economic systems. Research shows that reading plays a significant role in shaping analytical thinking and long-term decision-making. To illustrate this, we highlight a selection of data-driven insights and statistics connecting reading habits with financial awareness.

Reading 15–20 minutes per day significantly improves financial reasoning skills.

65% of new investors report that books helped them understand risk better than online tutorials.

Financial literacy is linked to higher long-term financial stability, regardless of income.

Behavioural finance books have grown by 40% in popularity in the last 5 years.

People who regularly read economics literature often show more consistent decision-making habits.

Printed books remain the most trusted format for learning financial concepts.

These facts highlight how reading supports long-term financial confidence. Our platform aims to make this learning journey clearer and more accessible.

We value transparency, so we include common questions readers often ask regarding our selection process, platform mission, and policy. This helps ensure clarity and trust in how lReads-Hub operates.

We measure educational quality, conceptual clarity, factual accuracy, and long-term relevance. Each book undergoes a structured review before being added.

No. Our project is fully independent and does not accept sponsored placements.

You can reach out via the Contact page. We review all suggestions to see if they align with our educational goals.

No. The platform shares educational information only.

Behind every book on lReads-Hub lies a structured, careful evaluation. Our team analyses whether a title provides genuine educational value, explains concepts clearly, and contributes to responsible financial knowledge. We do not aim to be a promotional catalogue — instead, we focus on guiding readers toward meaningful literature.

Professional background, research history, and subject expertise.

Does the book offer useful insights that support long-term understanding?

Is the content accessible to different levels of financial experience?

Can readers apply the ideas in real-world financial decision-making?

No commercial influence, partnerships, or sponsored additions.

This process ensures that every book we feature has genuine educational merit. We aim to maintain a balanced, comprehensive, and trustworthy literary environment that supports responsible learning. Readers can feel confident knowing each title has been evaluated independently.

Our catalogue is structured to help readers explore financial topics easily. Whether you're starting your learning journey or deepening advanced understanding, these categories guide you to relevant themes.

Books focused on long-term planning, portfolio building, and market principles.

Insights into human psychology and how it shapes financial behaviour.

Broader economic theories and market dynamics.

ESG frameworks, impact investing, and modern ethical finance.

Innovations in digital finance, AI, blockchain, and automation.

Titles connecting financial thinking with strategic decision-making.

These categories help structure the reader's journey and simplify choosing the next great book.